This new injection will allow the fund to further catalyze healthcare investments and achieve greater impact on healthcare for underserved populations in sub-Saharan Africa. Since 2010, Medical Credit Fund (MCF) has been working to provide access to credit for small and medium-sized healthcare enterprises in Africa. So far, more than USD 16 million in loans has been disbursed, leading to quality improvement at about 70% of the facilities.

While MCF will continue to cater to the needs of these health SMEs, the expansion will allow the fund to simultaneously meet the demand for larger and more flexible loans. It can now facilitate loans of up to USD 2.5 million – a significant step up from its previous USD 350,000 ceiling. Also, MCF can now finance not only healthcare providers but also other players in the healthcare sector such as medical education institutions or suppliers of medicines and equipment. Finally, the expansion will enable MCF to explore new partnerships in other countries in sub-Saharan Africa. As part of the mission to enhance affordable quality healthcare services for underserved populations, the loans are connected to an elaborate clinical and business improvement program offered in collaboration with PharmAccess and local technical assistance partners. This increases the impact of investments considerably.

OPIC, one of MCF’s first investors, has expanded their commitment to the fund. “Medical Credit Fund has truly been exceptional in their contribution to development by expanding the healthcare that is provided to low-income patients in Ghana, Kenya, Nigeria, Tanzania, and Uganda,” said Elizabeth L. Littlefield, OPIC’s President and CEO. “OPIC is pleased to support Medical Credit Fund as they continue to provide financing to small and medium-sized healthcare clinics throughout Sub-Saharan Africa.”

Calvert Foundation was also on board as one of the first investors in 2012. “We are thrilled to begin the next chapter of our relationship with MCF,” says Beth Bafford, Investments Director at Calvert Foundation. “Over the years, MCF has delivered proof of the power and impact of credit for businesses working in underserved or overlooked sectors. Their unique mix of capital, business and clinical support has yielded tremendous results. This new financing will also allow them to diversify outside of clinics to meet the needs they see evolving across medical education, supplies, devices, and distribution.”

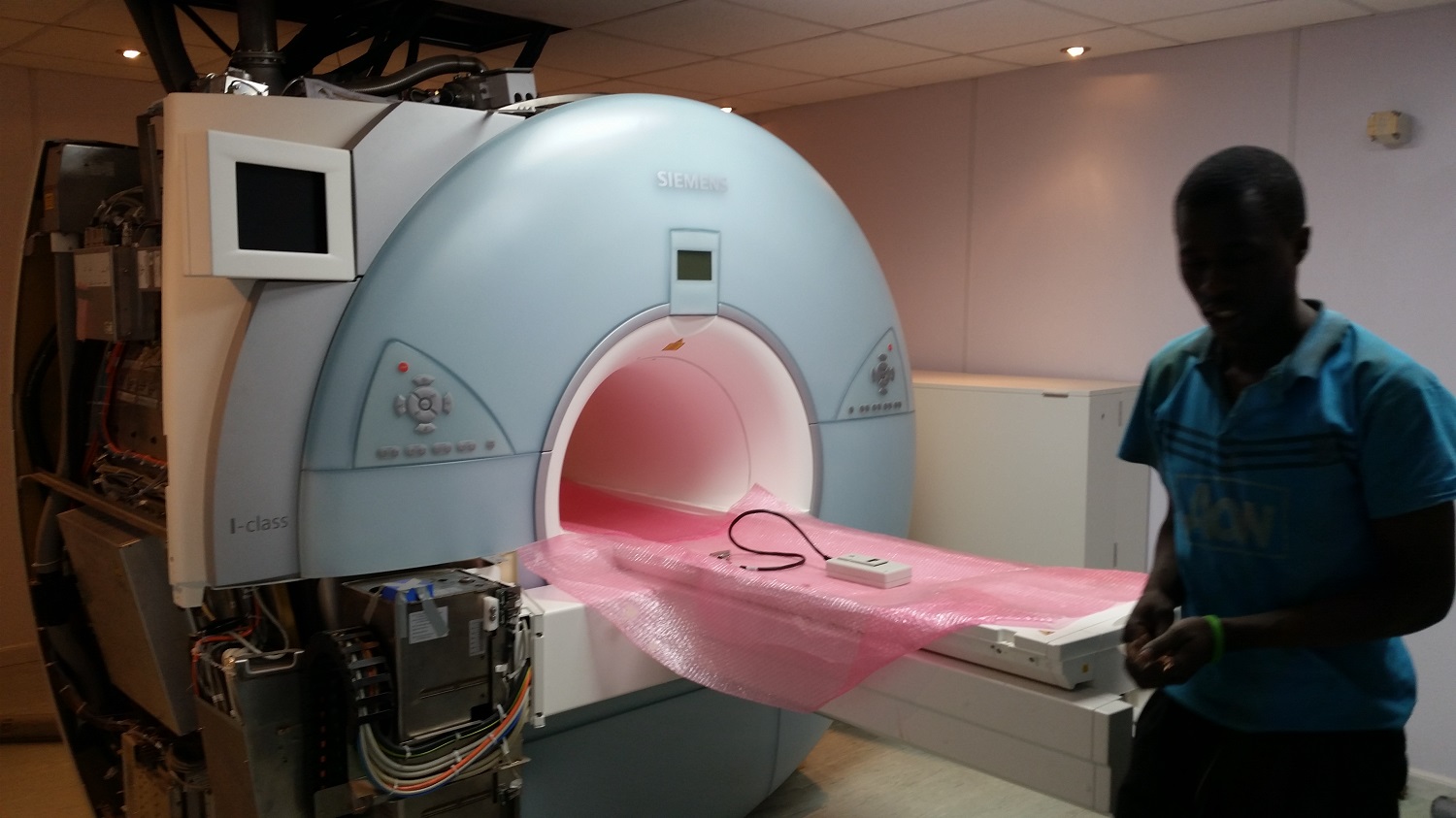

Although it delivers more than half of healthcare services, the private healthcare sector in Africa is chronically underfunded. Dr. Wisdom Amegbletor, CEO of New Crystal Health Services Limited, a chain of hospitals in Ghana, attests to the difficulty in obtaining capital. “Banks in Ghana shy away from the health sector and if they decide to lend to you they do so at cut throat interest rates. With MCF’s assistance I obtained a loan from uniBank which went into procuring badly needed supplies. It is refreshing to know that MCF is expanding its loan sizes and also seeking to cover the whole health value chain.”

Building on a strong foundation

Since starting operations in late 2010, MCF has made considerable headway in showing that health SMEs are bankable and that investing in the private healthcare sector pays. Its risk reduction and risk sharing model has been successful in attracting banks into the healthcare sector. The on average 97% repayment performance makes for an attractive portfolio. Now, banks regularly take the lead in seeking collaboration and are starting to take an increasingly large share of the risk in loan agreements with MCF.

Up to end of July 2016, MCF and its African partner banks disbursed more than USD 16 million in loans to over 650 healthcare providers. In collaboration with PharmAccess and technical assistance partners, it has trained more than 950 health SME staff members on both business performance and clinical performance, using the SafeCare standards. About 70% of healthcare providers show improvement in terms of quality of service delivery after their second SafeCare assessment.

“We have built strong partnerships, established more efficient processes and disbursed hundreds of loans to healthcare providers who were able to improve the quality of their services as a result. This track record would not have been possible without the commitment of our donors and investors, who recognized the business potential as well as the social importance of investing in the private healthcare sector. We are very proud to be taking this next step and look forward to achieving even more impact together,” said Managing Director of the Medical Credit Fund Monique Dolfing-Vogelenzang.

Catalytic capital

In 2012, MCF raised USD 10.6 million from OPIC and four leading international foundations. This was made possible by, among others, the Dutch government, the G20 SME Finance Challenge and the US Agency for International Development, who provided first loss and technical assistance grants to the fund.

In 2015, MCF started preparing for the expansion thanks to the support of the Dutch Good Growth Fund’s Seed Capital & Business Development (SCBD) program and Pfizer Foundation. Pfizer Foundation provided seed capital and SCBD provided a blended investment. This, in combination with a loan from Calvert Foundation, allowed MCF to reduce the investment risk for its follow on investors. Although the expansion builds on the experience and processes developed over the last five years, it also required the testing of innovative financing schemes for health SMEs, the development of an expanded pipeline and additional management capacity. Together, the grant, blended investment and loan had a catalytic effect on operations and on securing this next round of financing.

————————————————————————————–

OPIC is the U.S. Government’s development finance institution. It mobilizes private capital to help solve critical development challenges and in doing so, advances U.S. foreign policy. Because OPIC works with the U.S. private sector, it helps U.S. businesses gain footholds in emerging markets catalyzing revenues, jobs and growth opportunities both at home and abroad. OPIC achieves its mission by providing investors with financing, guarantees, political risk insurance, and support for private equity investment funds.

Calvert Foundation is a nonprofit impact investing organization that provides the opportunity for investors to achieve financial returns while empowering people living in low-income communities around the world. A pioneer in the impact investment field, Calvert Foundation creates a win-win by improving the lives of both those who receive investment dollars and the investors who support them. Calvert Foundation investors have created thousands of jobs, classroom seats, and business opportunities for low-income communities through their Community Investment Notes.

Medical Credit Fund, initiated by the PharmAccess Group with support from De Grote Onderneming and Aidsfonds, is a Netherlands based social impact fund that enables Health SMEs in sub-Saharan Africa to access affordable finance in order to improve the quality of healthcare. By reducing the unknown risks of investing in smaller scale healthcare providers, it catalyzes financing that enables healthcare providers to invest in quality enhancement and expansion of their facility. The finance program is combined with technical support on quality improvement and business planning, delivered by PharmAccess and its partners. In 2010 MCF won the G20 SME Finance Challenge award, which was presented to its chairman by President Obama during the summit in Seoul. In 2014 it also received the OPIC Impact Award for Access to Finance.